Discounted Cash Flow Scalable Model

Discounted Cash Flow (DCF) models are one of the most fundamental tools used in Finance. At a high level, they convert Financial Statements and input assumptions into a dollar valuation amount, which can be used for determining a buy or sell price for a certain asset.

Before I started working in Data Science, I worked in Corporate Finance where we frequently created DCF models in Excel. Excel worked great for this, but I wanted to create a programmable version of the model, so I could easily scale the model across thousands of companies at once.

This model was created for a project in my Intro to Data Science Programming class, in which we needed to build a program that asked for inputs, and dynamically returns an output. In this case, the inputs are the financial statement details and underlying assumptions, and the output is a valuation amount and formatted Financial Statments and analysis.

In the future I am hoping to transform the model to be scalable across thousands of companies by connecting to databases (e.g., SEC Financial Statements database), and using statistical methods to autonomously determine reasonable assumptions. Although this project is faily basic, there is much to build on in the future.

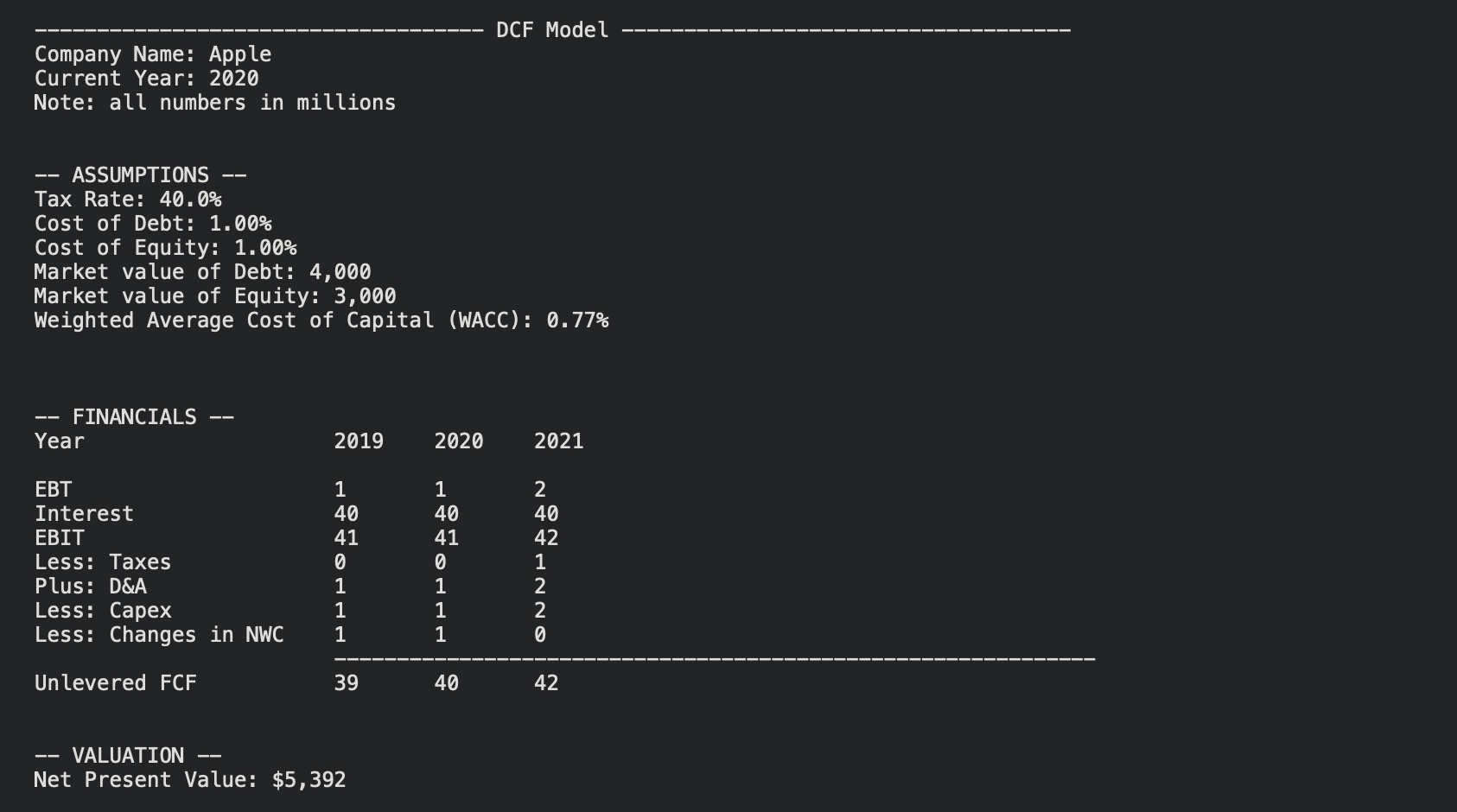

Here’s an example set of inputs to use (does not tie to any real company):

Company: Apple Entity: Total company Format: Millions Year: 2020 Number of historical periods: 3 Number of forecast periods: 4 Tax rate: .4 Equity market value: 30000 Debt market value: 4000 Cost of equity: .08 Cost of debt: .04 Current EBT: 5000 EBT prior year 1: 5000 EBT prior year 2: 5000 EBT prior year 3: 5000 Current D&A: 250 D&A prior year 1: 250 D&A prior year 2: 250 D&A prior year 3: 250 Current capex: 1000 Capex prior year 1: 1000 Capex prior year 2: 1000 Capex prior year 3: 1000 Current change in net working capital: 100 Capex for prior year 1: 50 Capex for prior year 2: 50 EBT growth: .1 D&A growth: .05 Capex growth: .15 Current NWC: 50 NWC prior year 1: 100 NWC prior year 2: 50 NWC prior year 3: 75 Current cash and marketable securities: 5000

Table of Contents:

- Create Prompt for Assumptions Input

- Create Prompt for Sensitivity Analysis

- Calculate Missing Income Statement Items

- Create Calculation for Valuation

- Create Calculations for Sensitivity Analysis

- Create an Execution Class

- Aggregate Results and Create Printable Format

- Execute Programs

1. Create Prompt for Assumptions Input

#this class creates the prompts needed to fill in the DCF model

class Assumptions():

def __init__(self):

'''

This class continuously prompts the user for inputs needed in order to complete the model.

This class stores all the variables to be used later in the model.

'''

self.prompt()

@classmethod

def prompt(cls):

'''

This method continuously prompts the user for inputs needed in order to complete the model.

This method stores all the variables to be used later in the model.

'''

#company name and entity

cls.company_name = input('''\n--Valuation Assistant--\n\nWelcome to the company Valuation Assistant tool. This tool simplifies valuation process by automatically generating models. This tool uses the Discounted Cash Flow Model (DCF) as well as a scenario analysis tool. Please input your assumptions into the upcoming prompts. A visualized model will be output at the end. Please enter only reasonable numbers found on a typical income statement. Error messages will not be available for incalculable numbers because of processing limits.\nEnter company name: ''')

cls.entity_name = input('Enter entity name: ')

#note on the format of the numbers (thousands or millions, etc.)

while True:

try:

cls.num_format = input('Would you like to show this in thousands, millions, or billons (enter either "thousands", "millions", or "billions")?: ').lower()

if cls.num_format not in ['thousands', 'millions', 'billions']:

raise Exception('Invalid entry. Please try again')

break

except Exception as e:

print(e)

while True:

try:

cls.current_year = int(input('Enter year for income statement to end on: '))

if (int(cls.current_year) < 1900) or (int(cls.current_year) >= 2030):

raise Exception('Invalid year entered. Please try again.')

break

except ValueError:

print('Invalid year entered. Please try again.')

except Exception as e:

print(e)

#the model layout changes based on how many historical periods you enter in the prompt below

while True:

try:

cls.num_hst_periods = int(input('How many number of historical periods would you like to show (enter a number between 1 and 3)?: '))

if (int(cls.num_hst_periods) < 1) or (int(cls.num_hst_periods) > 3):

raise Exception('Invalid number entered. Please try again.')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

#same with number of forecast periods

while True:

try:

cls.num_fcst_periods = int(input('How many number of forecast periods would you like to show (enter a number between 1 and 4)?: '))

if (int(cls.num_fcst_periods) < 1) or (int(cls.num_fcst_periods) > 4):

raise Exception('Invalid number entered. Please try again.')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.tax_rate = float(input('Enter a tax rate (as a decimal between 0 and 1): '))

if (float(cls.tax_rate) < 0) or (float(cls.tax_rate) > 1):

raise Exception('Invalid number entered. Please try again.')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.equity_market_value = float(input('Enter the equity market value: '))

break

except ValueError:

print('Invalid number entered. Please try again.')

while True:

try:

cls.debt_market_value = float(input('Enter the debt market value of : '))

break

except ValueError:

print('Invalid number entered. Please try again.')

while True:

try:

cls.cost_of_equity = float(input('Enter a cost of equity amount (as a decimal between 0 and 1): '))

if (float(cls.cost_of_equity) < 0) or (float(cls.cost_of_equity) > 1):

raise Exception('Invalid number entered. Please try again.')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.cost_of_debt = float(input('Enter a cost of debt amount (as a decimal between 0 and 1): '))

if (float(cls.cost_of_debt) < 0) or (float(cls.cost_of_debt) > 1):

raise Exception('Invalid number entered. Please try again.')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.ebt = float(input('Enter the current year Earnings Before Tax (EBT) amount: '))

cls.ebt_py_1 = float(input('Enter the Earnings Before Tax (EBT) amount for prior year 1: '))

if float(cls.num_hst_periods) >= 2:

cls.ebt_py_2 = float(input('Enter the Earnings Before Tax (EBT) amount for prior year 2: '))

if float(cls.num_hst_periods) >= 3:

cls.ebt_py_3 = float(input('Enter the Earnings Before Tax (EBT) amount for prior year 3: '))

break

except ValueError:

print('An invalid number was entered. Please enter EBT amounts again.')

while True:

try:

cls.da = float(input('Enter current year D&A amount (as a positive number): '))

if (cls.da < 0):

raise Exception('Amount cannot be negative. Please try again.')

cls.da_py_1 = float(input('Enter the D&A amount for prior year 1: '))

if (cls.da_py_1 < 0):

raise Exception('Amount cannot be negative. Please try again.')

if float(cls.num_hst_periods) >= 2:

cls.da_py_2 = float(input('Enter the D&A amount for prior year 2: '))

if (cls.da_py_2 < 0):

raise Exception('Amount cannot be negative. Please try again.')

if float(cls.num_hst_periods) >= 3:

cls.da_py_3 = float(input('Enter the D&A amount for prior year 3: '))

if (cls.da_py_3 < 0):

raise Exception('Amount cannot be negative. Please try again.')

break

except ValueError:

print('Invalid entry. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.capex = float(input('Enter current year capital expenditures amount (as a positive number): '))

if (cls.capex < 0):

raise Exception('Amounts cannot be negative. Please try again.')

cls.capex_py_1 = float(input('Enter the capex amount for prior year 1: '))

if (cls.capex_py_1 < 0):

raise Exception('Amounts cannot be negative. Please try again.')

if float(cls.num_hst_periods) >= 2:

cls.capex_py_2 = float(input('Enter the capex amount for prior year 2: '))

if (cls.capex_py_2 < 0):

raise Exception('Amounts cannot be negative. Please try again.')

if float(cls.num_hst_periods) >= 3:

cls.capex_py_3 = float(input('Enter the capex amount for prior year 3: '))

if (cls.capex_py_3 < 0):

raise Exception('Amounts cannot be negative. Please try again.')

break

except ValueError:

print('Invalid entry. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.nwc = float(input('Enter the current year change in net working capital (as either a positive or negative number): '))

cls.nwc_py_1 = float(input('Enter the change in net working capital for prior year 1: '))

if float(cls.num_hst_periods) >= 2:

cls.nwc_py_2 = float(input('Enter the change in net working capital for prior year 2: '))

if float(cls.num_hst_periods) >= 3:

cls.nwc_py_3 = float(input('Enter the change in net working capital for prior year 3: '))

break

except ValueError:

print('Invalid entry. Please try again.')

while True:

try:

cls.ebt_gr = float(input('Enter your forecasted EBT growth rate (as a decimal): '))

if (cls.ebt_gr > 1) | (cls.ebt_gr < -1):

raise Exception('Please enter a growth rate lower than 100%')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(2)

while True:

try:

cls.da_gr = float(input('Enter your forecasted D&A growth rate (as a decimal): '))

if (cls.da_gr > 1) | (cls.da_gr < -1):

raise Exception('Please enter a growth rate lower than 100%')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.capex_gr = float(input('Enter your capex growth rate (as a decimal): '))

if (cls.capex_gr > 1) | (cls.capex_gr < -1):

raise Exception('Please enter a growth rate lower than 100%')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.current_nwc = float(input('Enter current NWC amount: '))

cls.nwc_amt_fp_1 = float(input('Enter your forecasted NWC amount for forecast period 1: '))

if cls.nwc_amt_fp_1 < 0:

raise Exception('Amount must be greater than or equal to zero. Please try again')

if cls.num_fcst_periods >= 2:

cls.nwc_amt_fp_2 = float(input('Enter your forecasted NWC amount for forecast period 2: '))

if cls.nwc_amt_fp_2 < 0:

raise Exception('Amount must be greater than or equal to zero. Please try again')

if cls.num_fcst_periods >= 3:

cls.nwc_amt_fp_3 = float(input('Enter your forecasted NWC amount for forecast period 3: '))

if cls.nwc_amt_fp_3 < 0:

raise Exception('Amount must be greater than or equal to zero. Please try again')

if cls.num_fcst_periods == 4:

cls.nwc_amt_fp_4 = float(input('Enter your forecasted NWC amount for forecast period 4: '))

if cls.nwc_amt_fp_4 < 0:

raise Exception('Amount must be greater than or equal to zero. Please try again')

break

except ValueError:

print('Invalid number entered. Please try again.')

except Exception as e:

print(e)

while True:

try:

cls.cash = float(input('Enter current cash and marketable securities amount: '))

break

except ValueError:

print('Invalid number entered. Please try again.')

2. Create Prompt for Sensitivity Analysis

#this class is used for later in the model when variables need to be changed.

#a class was needed in order to go back and change the values based on a list input at a later point in time.

class SensitivityInput(Assumptions):

def __init__(self):

'''

This class is used for later in the model when variables need to be changed. A class was needed in order to

go back and change the values based on a list input at a later point in time.

'''

pass

@classmethod

def sensitivity_input(cls, input_variable, variable_amount):

'''

This method is used for later in the model when variables need to be changed. A class was needed in order to

go back and change the values based on a list input at a later point in time.

'''

#how variable are exchanged

if input_variable == 'ebt_gr':

Assumptions.ebt_gr = float(variable_amount)

if input_variable == 'capex_gr':

Assumptions.capex_gr = float(variable_amount)

if input_variable == 'da_gr':

Assumptions.da_gr = float(variable_amount)

if input_variable == 'cost_of_debt':

Assumptions.cost_of_debt = float(variable_amount)

if input_variable == 'tax_rate':

Assumptions.tax_rate = float(variable_amount)

3. Calculate Missing Income Statement Items

#this class conducts the calculations needed to complete the DCF model. It leverages the inputs from the Assumptions class.

class IncomeStatementCalculations(SensitivityInput):

def __init__(self):

'''

A DCF model is calculated based off of free cash flow. But only a small amount of assumptions were collected in order to find out free cash flow. This

class calculates the missing pieces needed to calculate free cash flow based on the input assumptions above.

'''

self.calcs()

@classmethod

def calcs(cls):

'''

A DCF model is calculated based off of free cash flow. But only a small amount of assumptions were collected in order to find out free cash flow. This

class calculates the missing pieces needed to calculate free cash flow based on the input assumptions above.

'''

#create forecasted amounts for ebt, da, capex, and nwc (using input growth rates)

cls.ebt_fcst_1 = (1 + Assumptions.ebt_gr) * Assumptions.ebt

cls.da_fcst_1 = (1 + Assumptions.da_gr) * Assumptions.da

cls.capex_fcst_1 = (1 + Assumptions.capex_gr) * Assumptions.capex

cls.nwc_fcst_1 = Assumptions.nwc_amt_fp_1 - Assumptions.current_nwc

if Assumptions.num_fcst_periods >= 2:

cls.ebt_fcst_2 = (1 + Assumptions.ebt_gr) * cls.ebt_fcst_1

cls.da_fcst_2 = (1 + Assumptions.da_gr) * cls.da_fcst_1

cls.capex_fcst_2 = (1 + Assumptions.capex_gr) * cls.capex_fcst_1

cls.nwc_fcst_2 = Assumptions.nwc_amt_fp_2 - Assumptions.nwc_amt_fp_1

if Assumptions.num_fcst_periods >= 3:

cls.ebt_fcst_3 = (1 + Assumptions.ebt_gr) * cls.ebt_fcst_2

cls.da_fcst_3 = (1 + Assumptions.da_gr) * cls.da_fcst_2

cls.capex_fcst_3 = (1 + Assumptions.capex_gr) * cls.capex_fcst_2

cls.nwc_fcst_3 = Assumptions.nwc_amt_fp_3 - Assumptions.nwc_amt_fp_2

if Assumptions.num_fcst_periods >= 4:

cls.ebt_fcst_4 = (1 + Assumptions.ebt_gr) * cls.ebt_fcst_3

cls.da_fcst_4 = (1 + Assumptions.da_gr) * cls.da_fcst_3

cls.capex_fcst_4 = (1 + Assumptions.capex_gr) * cls.capex_fcst_3

cls.nwc_fcst_4 = Assumptions.nwc_amt_fp_4 - Assumptions.nwc_amt_fp_3

#calculate wacc

cls.enterprise_value = Assumptions.debt_market_value + Assumptions.equity_market_value - Assumptions.cash

cls.debt_value_percentage = Assumptions.debt_market_value / cls.enterprise_value

cls.equity_value_percentage = Assumptions.equity_market_value / cls.enterprise_value

cls.wacc = (Assumptions.cost_of_equity * cls.equity_value_percentage) + ((Assumptions.cost_of_debt * cls.debt_value_percentage) * (1 - Assumptions.tax_rate))

#complete missing income statement items (interest, taxes, ebit, unlevered fcf) - both for historical and forecast periods

cls.unlevered_fcf_list = []

cls.interest = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**0)) * Assumptions.cost_of_debt

cls.taxes = Assumptions.tax_rate * Assumptions.ebt

cls.ebit = Assumptions.ebt + cls.interest

cls.unlevered_fcf = ((cls.ebit - cls.taxes) + Assumptions.da) - Assumptions.capex - Assumptions.nwc

cls.interest_py_1 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**(-1))) * Assumptions.cost_of_debt

cls.taxes_py_1 = Assumptions.tax_rate * Assumptions.ebt_py_1

cls.ebit_py_1 = Assumptions.ebt_py_1 + cls.interest_py_1

cls.unlevered_fcf_py_1 = ((cls.ebit_py_1 - cls.taxes_py_1) + Assumptions.da_py_1) - Assumptions.capex_py_1 - Assumptions.nwc_py_1

if Assumptions.num_hst_periods >= 2:

cls.interest_py_2 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**(-2))) * Assumptions.cost_of_debt

cls.taxes_py_2 = Assumptions.tax_rate * Assumptions.ebt_py_2

cls.ebit_py_2 = Assumptions.ebt_py_2 + cls.interest_py_2

cls.unlevered_fcf_py_2 = ((cls.ebit_py_2 - cls.taxes_py_2) + Assumptions.da_py_2) - Assumptions.capex_py_2 - Assumptions.nwc_py_2

if Assumptions.num_hst_periods >= 3:

cls.interest_py_3 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**(-3))) * Assumptions.cost_of_debt

cls.taxes_py_3 = Assumptions.tax_rate * Assumptions.ebt_py_3

cls.ebit_py_3 = Assumptions.ebt_py_3 + cls.interest_py_3

cls.unlevered_fcf_py_3 = ((cls.ebit_py_3 - cls.taxes_py_3) + Assumptions.da_py_3) - Assumptions.capex_py_3 - Assumptions.nwc_py_3

cls.taxes_fcst_1 = Assumptions.tax_rate * cls.ebt_fcst_1

cls.interest_fcst_1 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**1)) * Assumptions.cost_of_debt

cls.ebit_fcst_1 = cls.ebt_fcst_1 + cls.interest_fcst_1

cls.unlevered_fcf_fcst_1 = ((cls.ebit_fcst_1 - cls.taxes_fcst_1) + cls.da_fcst_1) - cls.capex_fcst_1 - cls.nwc_fcst_1

cls.unlevered_fcf_list.append(cls.unlevered_fcf_fcst_1)

if Assumptions.num_fcst_periods >= 2:

cls.taxes_fcst_2 = Assumptions.tax_rate * cls.ebt_fcst_2

cls.interest_fcst_2 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**2)) * Assumptions.cost_of_debt

cls.ebit_fcst_2 = cls.ebt_fcst_2 + cls.interest_fcst_2

cls.unlevered_fcf_fcst_2 = ((cls.ebit_fcst_2 - cls.taxes_fcst_2) + cls.da_fcst_2) - cls.capex_fcst_2 - cls.nwc_fcst_2

cls.unlevered_fcf_list.append(cls.unlevered_fcf_fcst_2)

if Assumptions.num_fcst_periods >= 3:

cls.taxes_fcst_3 = Assumptions.tax_rate * cls.ebt_fcst_3

cls.interest_fcst_3 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**3)) * Assumptions.cost_of_debt

cls.ebit_fcst_3 = cls.ebt_fcst_3 + cls.interest_fcst_3

cls.unlevered_fcf_fcst_3 = ((cls.ebit_fcst_3 - cls.taxes_fcst_3) + cls.da_fcst_3) - cls.capex_fcst_3 - cls.nwc_fcst_3

cls.unlevered_fcf_list.append(cls.unlevered_fcf_fcst_3)

if Assumptions.num_fcst_periods >= 4:

cls.taxes_fcst_4 = Assumptions.tax_rate * cls.ebt_fcst_4

cls.interest_fcst_4 = (Assumptions.debt_market_value * ((1 + Assumptions.cost_of_debt)**4)) * Assumptions.cost_of_debt

cls.ebit_fcst_4 = cls.ebt_fcst_4 + cls.interest_fcst_4

cls.unlevered_fcf_fcst_4 = (((cls.ebit_fcst_4 - cls.taxes_fcst_4) + cls.da_fcst_4) - cls.capex_fcst_4 - cls.nwc_fcst_4)

cls.unlevered_fcf_list.append(cls.unlevered_fcf_fcst_4)

#create terminal value calculations

cls.ev_ebitda_multiple = cls.enterprise_value / (Assumptions.ebt + cls.interest + Assumptions.da)

if Assumptions.num_fcst_periods == 1:

cls.perpetual_growth = cls.unlevered_fcf_fcst_1 / cls.wacc

cls.ev_over_ebitda = cls.ebit_fcst_1 * cls.ev_ebitda_multiple

if Assumptions.num_fcst_periods == 2:

cls.perpetual_growth = cls.unlevered_fcf_fcst_2 / cls.wacc

cls.ev_over_ebitda = cls.ebit_fcst_2 * cls.ev_ebitda_multiple

if Assumptions.num_fcst_periods == 3:

cls.perpetual_growth = cls.unlevered_fcf_fcst_3 / cls.wacc

cls.ev_over_ebitda = cls.ebit_fcst_3 * cls.ev_ebitda_multiple

if Assumptions.num_fcst_periods == 4:

cls.perpetual_growth = cls.unlevered_fcf_fcst_4 / cls.wacc

cls.ev_over_ebitda = cls.ebit_fcst_4 * cls.ev_ebitda_multiple

4. Create Calculation for Valuation

#this class conducts the DCF valuation calculation

class ValuationCalculations(IncomeStatementCalculations):

def __init__(self):

'''

This class leverages all the objects from the previous classes to calculate net present value.

'''

self.npv_calc()

@classmethod

def npv_calc(cls):

'''

This method leverages all the objects from the previous classes to calculate net present value.

'''

cls.npv_perpetual_growth = 0

#net present value calculation varies based on how many forecast periods are selected

for x in IncomeStatementCalculations.unlevered_fcf_list:

j = 1

if x == IncomeStatementCalculations.unlevered_fcf_list[len(IncomeStatementCalculations.unlevered_fcf_list)-1]:

cls.npv_perpetual_growth += ((x + IncomeStatementCalculations.perpetual_growth) / ((1 + IncomeStatementCalculations.wacc) ** j))

else:

cls.npv_perpetual_growth += (x / ((1 + IncomeStatementCalculations.wacc) ** j))

j += 1

5. Create Calculations for Sensitivity Analysis

#this class takes an input variable and values to adjust that variable by and recalculates net present value for each of them

class ExecuteSensitivity(ValuationCalculations):

def __init__(self):

'''

This class takes an input variable and values to adjust that variable by and recalculates net present value for each of them.

'''

self.orig_npv()

@classmethod

def orig_npv(cls):

'''

This method stores the current NPV value.

'''

cls.test_variable_1_npv_values = [ValuationCalculations.npv_perpetual_growth]

@classmethod

def execute_sensitivity(cls):

'''

This method takes an input variable and values to adjust that variable by and recalculates net present value for each of them.

'''

#input for which variable you would like to adjust

while True:

try:

cls.test_variables = list(input('Enter one variable you would like to manipulate?: (Enter either "ebt_gr", "capex_gr", "cost_of_debt", "tax_rate", or "da_gr"').split(', '))

if cls.test_variables not in [['ebt_gr'], ['capex_gr'], ['cost_of_debt'], ['tax_rate'], ['da_gr']]:

raise Exception('Please enter only one of the following: "ebt_gr", "capex_gr", "cost_of_debt", "tax_rate", "da_gr".')

break

except Exception as e:

print(e)

#input for the values you would like to adjust the variable above by

while True:

try:

cls.test_variable_1_values = list(map(float, input("Enter the range of values you would like to test for the first variable you listed (enter five separated by a comma and a space): ").split(', ')))

if len(cls.test_variable_1_values) != 5:

raise Exception('Please enter 5 variables separated by a comma and a space. Please try again.')

break

except ValueError:

print('Please only enter numeric variables. Please try again.')

except Exception as e:

print(e)

#store the original assumptions so that you can reset the classes after each of the variables are tested

cls.test_variable_1_npv_values = [ValuationCalculations.npv_perpetual_growth]

cls.original_ebt_gr = Assumptions.ebt_gr

cls.original_capex_gr = Assumptions.capex_gr

cls.original_da_gr = Assumptions.da_gr

cls.original_tax_rate = Assumptions.tax_rate

cls.original_cost_of_debt = Assumptions.cost_of_debt

#recalculate net present value for each of the input values

for x in cls.test_variable_1_values:

SensitivityInput.sensitivity_input(cls.test_variables[0], x)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

#store the value to be printed out later. Since the model will be reset to the original assumptions afterwards.

cls.test_variable_1_npv_values.append(cls.temp_object.npv_perpetual_growth)

#reset the model to the original assumption. So that the model prints out the original inputs when completed.

SensitivityInput.sensitivity_input(cls.test_variables[0], cls.original_ebt_gr)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

6. Create an Execution Class

#this class executes the Solver function.

#the solver function takes an input target NPV value and an input variable, and finds the minimum value of the

#input variable needed to achieve the input target NPV.

class ExecuteSolver(ExecuteSensitivity):

def __init__(self):

'''

This method executes the Solver function. The solver function takes an input target NPV value and an input variable, and finds the

minimum value of the input variable needed to achieve the input target NPV.

'''

pass

@classmethod

def execute_solver(cls):

'''

This method executes the Solver function. The solver function takes an input target NPV value and an input variable, and finds the

minimum value of the input variable needed to achieve the input target NPV.

'''

#input for target npv value

while True:

try:

cls.target_npv = float(input('Enter target NPV amount: '))

break

except ValueError:

print('Please enter a number. Please try again.')

#input for variable you would to adjust

while True:

try:

cls.solver_variable = input("Enter variable you would like to manipulate (Enter either 'ebt_gr', 'capex_gr', 'cost_of_debt', 'tax_rate', or 'da_gr') (Note: Please only enter reasonable variables. It is not recommended to use a variable that isn't a large portion of FCF (<50%)):")

if cls.solver_variable not in (['ebt_gr', 'capex_gr', 'cost_of_debt', 'tax_rate', 'da_gr']):

raise Exception('Please enter only one of the following: "ebt_gr", "capex_gr", "cost_of_debt", "tax_rate", "da_gr".')

break

except Exception as e:

print(e)

#save original assumptions so you can reset the model after the solver function completes.

cls.original_ebt_gr = Assumptions.ebt_gr

cls.original_capex_gr = Assumptions.capex_gr

cls.original_da_gr = Assumptions.da_gr

cls.original_tax_rate = Assumptions.tax_rate

cls.original_cost_of_debt = Assumptions.cost_of_debt

#initialize a temp model for the solver function to run on

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

#while loop that runs the solver. The loop is split up based on which variable is selected (a cost (negative) or a revenue (positive) variable).

#the loop sets a extreme minimum or maximum value and adjusts upwards or downwards based on whether the target is above or below the original npv value.

cls.counter = 1

while cls.counter == 1:

#in case the target is above the original npv value

if cls.temp_object2.npv_perpetual_growth < cls.target_npv:

#some variables are costs, some are revenue items, so whether the variable is increased or decreased depends on this

if cls.solver_variable in ['ebt_gr', 'da_gr', 'cost_of_debt']:

cls.increase_decrease = 'increase'

cls.j = -1

while cls.temp_object2.npv_perpetual_growth < cls.target_npv:

cls.j += .0001

SensitivityInput.sensitivity_input(cls.solver_variable, cls.j)

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

cls.counter += 1

#for the cost values

else:

cls.increase_decrease = 'decrease'

cls.j = 1

while cls.temp_object2.npv_perpetual_growth < cls.target_npv:

cls.j -= .0001

SensitivityInput.sensitivity_input(cls.solver_variable, cls.j)

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

cls.counter += 1

#in case the target is below the original npv value

elif cls.temp_object2.npv_perpetual_growth > cls.target_npv:

if cls.solver_variable in ['ebt_gr', 'da_gr', 'cost_of_debt']:

cls.increase_decrease = 'decrease'

cls.j = 1

while cls.temp_object2.npv_perpetual_growth > cls.target_npv:

cls.j -= .0001

SensitivityInput.sensitivity_input(cls.solver_variable, cls.j)

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

cls.counter += 1

#for the cost values

else:

cls.increase_decrease = 'increase'

cls.j = -1

while cls.temp_object2.npv_perpetual_growth > cls.target_npv:

cls.j += .0001

SensitivityInput.sensitivity_input(cls.solver_variable, cls.j)

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

cls.counter += 1

#store the answer

cls.ebt_answer = cls.temp_object2.ebt_gr

cls.capex_answer = cls.temp_object2.capex_gr

cls.da_answer = cls.temp_object2.da_gr

cls.tax_rate_answer = cls.temp_object2.tax_rate

cls.cost_of_debt_answer = cls.temp_object2.cost_of_debt

#reset to the model to the original values so it can be printed out

if cls.solver_variable == 'ebt_gr':

SensitivityInput.sensitivity_input('ebt_gr', cls.original_ebt_gr)

cls.temp_object2=IncomeStatementCalculations()

cls.temp_object2=ValuationCalculations()

if cls.solver_variable == 'da_gr':

SensitivityInput.sensitivity_input('da_gr', cls.original_da_gr)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

if cls.solver_variable == 'capex_gr':

SensitivityInput.sensitivity_input('capex_gr', cls.original_capex_gr)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

if cls.solver_variable == 'tax_rate':

SensitivityInput.sensitivity_input('tax_rate', cls.original_tax_rate)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

if cls.solver_variable == 'cost_of_debt':

SensitivityInput.sensitivity_input('cost_of_debt', cls.original_cost_of_debt)

cls.temp_object=IncomeStatementCalculations()

cls.temp_object=ValuationCalculations()

7. Aggregate Results and Create Printable Format

#this class prints out the results from the above into a readable format

class PrintModel(ExecuteSolver):

def __init__(self):

'This class prints out the results from the above into a readable format.'

#initialize for the default print out

self.top_section()

self.create_line_items()

self.middle_section()

self.valuation_section()

self.income_statement = ''

self.income_statement = self.top_section + self.income_statement_body + self.bottom_section

def top_section(self):

'Method for creating the header of the print out'

#the top section prints out important assumptions that were input

self.top_section_header = '\n\n' + '--'*18 + ' DCF Model ' + '--'*18 + '\n'

self.top_section = (self.top_section_header + f'Company Name: {Assumptions.company_name}\nCurrent Year: {Assumptions.current_year}\nNote: all numbers in {Assumptions.num_format}\n'

+ f'\n\n-- ASSUMPTIONS --\nTax Rate: {Assumptions.tax_rate*100:.1f}%\nCost of Debt: {Assumptions.cost_of_debt*100:.2f}%\nCost of Equity: {Assumptions.cost_of_equity*100:.2f}%\n'

+ f'Market value of Debt: {Assumptions.debt_market_value:,.0f}\nMarket value of Equity: {Assumptions.equity_market_value:,.0f}\nWeighted Average Cost of Capital (WACC): {IncomeStatementCalculations.wacc*100:.2f}%\n')

def middle_section(self):

'Method for creating the body of the print out'

self.years = []

#create the header for years. the years header changes based on current year, as well as number of historical and forecast periods

for x in reversed(range(1, Assumptions.num_hst_periods+1)):

self.years.append(str(Assumptions.current_year - x))

self.years.append(str(Assumptions.current_year))

for x in range(1, Assumptions.num_fcst_periods+1):

self.years.append(str(Assumptions.current_year + x))

self.years = '\t'.join(self.years)

#combine all components of the middle section with the exception of the line items

self.income_statement_body = ('\n\n\n-- FINANCIALS --\nYear' + '\t'*3 + f'{self.years}\n\n{self.ebt_line}\n{self.interest_line}\n{self.ebit_line}\n{self.taxes_line}\n'

+ f'{self.da_line}\n{self.capex_line}\n{self.nwc_line}\n' + '\t'*3 + '-'*61 + f'\n{self.unlevered_fcf_line}')

def create_line_items(self):

'Method for creating the individual line items of the print out'

#since a varying number of historical and forecast periods can be input, make the output changed based on those values

self.ebt_hst_line = ('EBT' + ' '*((8*3)-3) + f"{Assumptions.ebt_py_1:,.0f}")

self.interest_hst_line = ('Interest' + ' '*((8*3)-8) + f"{IncomeStatementCalculations.interest_py_1:,.0f}")

self.ebit_hst_line = ('EBIT' + ' '*((8*3)-4) + f"{IncomeStatementCalculations.ebit_py_1:,.0f}")

self.taxes_hst_line = ('Less: Taxes' + ' '*((8*3)-11) + f"{IncomeStatementCalculations.taxes_py_1:,.0f}")

self.da_hst_line = ('Plus: D&A' + ' '*((8*3)-9) + f"{Assumptions.da_py_1:,.0f}")

self.capex_hst_line = ('Less: Capex' + ' '*((8*3)-11) + f"{Assumptions.capex_py_1:,.0f}")

self.nwc_hst_line = ('Less: Changes in NWC' + ' '*((8*3)-20) + f"{Assumptions.nwc_py_1:,.0f}")

self.unlevered_fcf_hst_line = ('Unlevered FCF' + ' '*((8*3)-13) + f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")

if Assumptions.num_hst_periods == 2:

self.ebt_hst_line = ('EBT' + ' '*((8*3)-3) + f"{Assumptions.ebt_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.ebt_py_2:,.0f}")-4))

+ f"{Assumptions.ebt_py_1:,.0f}")

self.interest_hst_line = ('Interest' + ' '*((8*3)-8) + f"{IncomeStatementCalculations.interest_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_2:,.0f}")-4))

+ f"{IncomeStatementCalculations.interest_py_1:,.0f}")

self.ebit_hst_line = ('EBIT' + ' '*((8*3)-4) + f"{IncomeStatementCalculations.ebit_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_2:,.0f}")-4))

+ f"{IncomeStatementCalculations.ebit_py_1:,.0f}")

self.taxes_hst_line = ('Less: Taxes' + ' '*((8*3)-11) + f"{IncomeStatementCalculations.taxes_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_2:,.0f}")-4))

+ f"{IncomeStatementCalculations.taxes_py_1:,.0f}")

self.da_hst_line = ('Plus: D&A' + ' '*((8*3)-9) + f"{Assumptions.da_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.da_py_2:,.0f}")-4))

+ f"{Assumptions.da_py_1:,.0f}")

self.capex_hst_line = ('Less: Capex' + ' '*((8*3)-11) + f"{Assumptions.capex_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.capex_py_2:,.0f}")-4))

+ f"{Assumptions.capex_py_1:,.0f}")

self.nwc_hst_line = ('Less: Changes in NWC' + ' '*((8*3)-20) + f"{Assumptions.nwc_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.nwc_py_2:,.0f}")-4))

+ f"{Assumptions.nwc_py_1:,.0f}")

self.unlevered_fcf_hst_line = ('Unlevered FCF' + ' '*((8*3)-13) + f"{IncomeStatementCalculations.unlevered_fcf_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_2:,.0f}")-4))

+ f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")

if Assumptions.num_hst_periods == 3:

self.ebt_hst_line = ('EBT' + ' '*((8*3)-3) + f"{Assumptions.ebt_py_3:,.0f}" + ' '*(4-(len(f"{Assumptions.ebt_py_3:,.0f}")-4))

+ f"{Assumptions.ebt_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.ebt_py_2:,.0f}")-4)) + f"{Assumptions.ebt_py_1:,.0f}")

self.interest_hst_line = ('Interest' + ' '*((8*3)-8) + f"{IncomeStatementCalculations.interest_py_3:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_3:,.0f}")-4))

+ f"{IncomeStatementCalculations.interest_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_2:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_py_1:,.0f}")

self.ebit_hst_line = ('EBIT' + ' '*((8*3)-4) + f"{IncomeStatementCalculations.ebit_py_3:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_3:,.0f}")-4))

+ f"{IncomeStatementCalculations.ebit_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_2:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_py_1:,.0f}")

self.taxes_hst_line = ('Less: Taxes' + ' '*((8*3)-11) + f"{IncomeStatementCalculations.taxes_py_3:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_3:,.0f}")-4))

+ f"{IncomeStatementCalculations.taxes_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_2:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_py_1:,.0f}")

self.da_hst_line = ('Plus: D&A' + ' '*((8*3)-9) + f"{Assumptions.da_py_3:,.0f}" + ' '*(4-(len(f"{Assumptions.da_py_3:,.0f}")-4))

+ f"{Assumptions.da_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.da_py_2:,.0f}")-4)) + f"{Assumptions.da_py_1:,.0f}")

self.capex_hst_line = ('Less: Capex' + ' '*((8*3)-11) + f"{Assumptions.capex_py_3:,.0f}" + ' '*(4-(len(f"{Assumptions.capex_py_3:,.0f}")-4))

+ f"{Assumptions.capex_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.capex_py_2:,.0f}")-4)) + f"{Assumptions.capex_py_1:,.0f}")

self.nwc_hst_line = ('Less: Changes in NWC' + ' '*((8*3)-20) + f"{Assumptions.nwc_py_3:,.0f}" + ' '*(4-(len(f"{Assumptions.nwc_py_3:,.0f}")-4))

+ f"{Assumptions.nwc_py_2:,.0f}" + ' '*(4-(len(f"{Assumptions.nwc_py_2:,.0f}")-4)) + f"{Assumptions.nwc_py_1:,.0f}")

self.unlevered_fcf_hst_line = ('Unlevered FCF' + ' '*((8*3)-13) + f"{IncomeStatementCalculations.unlevered_fcf_py_3:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_3:,.0f}")-4))

+ f"{IncomeStatementCalculations.unlevered_fcf_py_2:,.0f}" + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_2:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")

self.ebt_line = (self.ebt_hst_line + ' '*(4-(len(f"{Assumptions.ebt_py_1:,.0f}")-4)) + f"{Assumptions.ebt:,.0f}"

+ ' '*(4-(len(f"{Assumptions.ebt:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}")

self.interest_line = (self.interest_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_1:,.0f}")

self.ebit_line = (self.ebit_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}")

self.taxes_line = (self.taxes_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}")

self.da_line = (self.da_hst_line + ' '*(4-(len(f"{Assumptions.da_py_1:,.0f}")-4)) + f"{Assumptions.da:,.0f}"

+ ' '*(4-(len(f"{Assumptions.da:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_1:,.0f}")

self.capex_line = (self.capex_hst_line + ' '*(4-(len(f"{Assumptions.capex_py_1:,.0f}")-4)) + f"{Assumptions.capex:,.0f}"

+ ' '*(4-(len(f"{Assumptions.capex:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_1:,.0f}")

self.nwc_line = (self.nwc_hst_line + ' '*(4-(len(f"{Assumptions.nwc_py_1:,.0f}")-4)) + f"{Assumptions.nwc:,.0f}"

+ ' '*(4-(len(f"{Assumptions.nwc:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}")

self.unlevered_fcf_line = (self.unlevered_fcf_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}")

if Assumptions.num_fcst_periods == 2:

self.ebt_line = (self.ebt_hst_line + ' '*(4-(len(f"{Assumptions.ebt_py_1:,.0f}")-4)) + f"{Assumptions.ebt:,.0f}"

+ ' '*(4-(len(f"{Assumptions.ebt:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}")

self.interest_line = (self.interest_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_2:,.0f}")

self.ebit_line = (self.ebit_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_2:,.0f}")

self.taxes_line = (self.taxes_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_2:,.0f}")

self.da_line = (self.da_hst_line + ' '*(4-(len(f"{Assumptions.da_py_1:,.0f}")-4)) + f"{Assumptions.da:,.0f}"

+ ' '*(4-(len(f"{Assumptions.da:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_2:,.0f}")

self.capex_line = (self.capex_hst_line + ' '*(4-(len(f"{Assumptions.capex_py_1:,.0f}")-4)) + f"{Assumptions.capex:,.0f}"

+ ' '*(4-(len(f"{Assumptions.capex:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_2:,.0f}")

self.nwc_line = (self.nwc_hst_line + ' '*(4-(len(f"{Assumptions.nwc_py_1:,.0f}")-4)) + f"{Assumptions.nwc:,.0f}"

+ ' '*(4-(len(f"{Assumptions.nwc:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_2:,.0f}")

self.unlevered_fcf_line = (self.unlevered_fcf_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}")

if Assumptions.num_fcst_periods == 3:

self.ebt_line = (self.ebt_hst_line + ' '*(4-(len(f"{Assumptions.ebt_py_1:,.0f}")-4)) + f"{Assumptions.ebt:,.0f}"

+ ' '*(4-(len(f"{Assumptions.ebt:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_3:,.0f}")

self.interest_line = (self.interest_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_3:,.0f}")

self.ebit_line = (self.ebit_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_3:,.0f}")

self.taxes_line = (self.taxes_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_3:,.0f}")

self.da_line = (self.da_hst_line + ' '*(4-(len(f"{Assumptions.da_py_1:,.0f}")-4)) + f"{Assumptions.da:,.0f}"

+ ' '*(4-(len(f"{Assumptions.da:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_3:,.0f}")

self.capex_line = (self.capex_hst_line + ' '*(4-(len(f"{Assumptions.capex_py_1:,.0f}")-4)) + f"{Assumptions.capex:,.0f}"

+ ' '*(4-(len(f"{Assumptions.capex:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_3:,.0f}")

self.nwc_line = (self.nwc_hst_line + ' '*(4-(len(f"{Assumptions.nwc_py_1:,.0f}")-4)) + f"{Assumptions.nwc:,.0f}"

+ ' '*(4-(len(f"{Assumptions.nwc:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_3:,.0f}")

self.unlevered_fcf_line = (self.unlevered_fcf_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_3:,.0f}")

if Assumptions.num_fcst_periods == 4:

self.ebt_line = (self.ebt_hst_line + ' '*(4-(len(f"{Assumptions.ebt_py_1:,.0f}")-4)) + f"{Assumptions.ebt:,.0f}"

+ ' '*(4-(len(f"{Assumptions.ebt:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebt_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.ebt_fcst_4:,.0f}")

self.interest_line = (self.interest_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.interest_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.interest_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.interest_fcst_4:,.0f}")

self.ebit_line = (self.ebit_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.ebit_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.ebit_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.ebit_fcst_4:,.0f}")

self.taxes_line = (self.taxes_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.taxes_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.taxes_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.taxes_fcst_4:,.0f}")

self.da_line = (self.da_hst_line + ' '*(4-(len(f"{Assumptions.da_py_1:,.0f}")-4)) + f"{Assumptions.da:,.0f}"

+ ' '*(4-(len(f"{Assumptions.da:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.da_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.da_fcst_4:,.0f}")

self.capex_line = (self.capex_hst_line + ' '*(4-(len(f"{Assumptions.capex_py_1:,.0f}")-4)) + f"{Assumptions.capex:,.0f}"

+ ' '*(4-(len(f"{Assumptions.capex:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.capex_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.capex_fcst_4:,.0f}")

self.nwc_line = (self.nwc_hst_line + ' '*(4-(len(f"{Assumptions.nwc_py_1:,.0f}")-4)) + f"{Assumptions.nwc:,.0f}"

+ ' '*(4-(len(f"{Assumptions.nwc:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.nwc_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.nwc_fcst_4:,.0f}")

self.unlevered_fcf_line = (self.unlevered_fcf_hst_line + ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_py_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_fcst_1:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_2:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_fcst_2:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_3:,.0f}"

+ ' '*(4-(len(f"{IncomeStatementCalculations.unlevered_fcf_fcst_3:,.0f}")-4)) + f"{IncomeStatementCalculations.unlevered_fcf_fcst_4:,.0f}")

def valuation_section(self):

'Method for creating the Valuation section of the print out'

self.npv_output = ExecuteSensitivity.test_variable_1_npv_values[0]

self.bottom_section = f"\n\n\n-- VALUATION --\nNet Present Value: ${self.npv_output:,.0f}\n\n\n"

def sensitivity_analysis_section(self):

'Method for creating the sensitivity section of the print out'

#print out results

self.sensitivity_section = (f'-- SENSITIVITY ANALYSIS --'

+ f'\n{ExecuteSensitivity.test_variables[0]} \tNPV'

+ f'\n{float(ExecuteSensitivity.test_variable_1_values[0])*100:.1f}%: \t{float(ExecuteSensitivity.test_variable_1_npv_values[1]):,.0f}'

+ f'\n{float(ExecuteSensitivity.test_variable_1_values[1])*100:.1f}%: \t{float(ExecuteSensitivity.test_variable_1_npv_values[2]):,.0f}'

+ f'\n{float(ExecuteSensitivity.test_variable_1_values[2])*100:.1f}%: \t{float(ExecuteSensitivity.test_variable_1_npv_values[3]):,.0f}'

+ f'\n{float(ExecuteSensitivity.test_variable_1_values[3])*100:.1f}%: \t{float(ExecuteSensitivity.test_variable_1_npv_values[4]):,.0f}'

+ f'\n{float(ExecuteSensitivity.test_variable_1_values[4])*100:.1f}%: \t{float(ExecuteSensitivity.test_variable_1_npv_values[5]):,.0f}')

#aggregate results

self.income_statement = self.top_section + self.income_statement_body + self.bottom_section + self.sensitivity_section

def solver_analysis_section(self):

'Method for creating the solver section of the print out'

#the print out changes depending on the which variable is input

if ExecuteSolver.solver_variable == 'ebt_gr':

self.solver_section = (f'\n\n\n-- SOLVER --\nEBT growth rate needs to {ExecuteSolver.increase_decrease} to {float(ExecuteSolver.ebt_answer)*100:.2f}% to achieve an NPV of ${float(ExecuteSolver.target_npv):,.0f}')

if ExecuteSolver.solver_variable == 'capex_gr':

self.solver_section = (f'\n\n\n-- SOLVER --\nCapex growth rate needs to {ExecuteSolver.increase_decrease} to {float(ExecuteSolver.capex_answer)*100:.2f}% to achieve an NPV of ${float(ExecuteSolver.target_npv):,.0f}')

if ExecuteSolver.solver_variable == 'da_gr':

self.solver_section = (f'\n\n\n-- SOLVER --\nD&A growth rate needs to {ExecuteSolver.increase_decrease} to {float(ExecuteSolver.da_answer)*100:.2f}% to achieve an NPV of ${float(ExecuteSolver.target_npv):,.0f}')

if ExecuteSolver.solver_variable == 'tax_rate':

self.solver_section = (f'\n\n\n-- SOLVER --\nTax rate needs to {ExecuteSolver.increase_decrease} to {float(ExecuteSolver.tax_rate_answer)*100:.2f}% to achieve an NPV of ${float(ExecuteSolver.target_npv):,.0f}')

if ExecuteSolver.solver_variable == 'cost_of_debt':

self.solver_section = (f'\n\n\n-- SOLVER --\nCost of debt needs to {ExecuteSolver.increase_decrease} to {float(ExecuteSolver.cost_of_debt_answer)*100}% to achieve a NPV of ${float(ExecuteSolver.target_npv):,.0f}')

#aggregate results

self.income_statement = self.top_section + self.income_statement_body + self.bottom_section + self.sensitivity_section + self.solver_section + '\n\n'

def __repr__(self):

'Print out model'

return self.income_statement

8. Execute programs

A. Run DCF model

#this section executes the assumptions prompts and returns a DCF model

print_mod=Assumptions()

print_mod=SensitivityInput()

print_mod=IncomeStatementCalculations()

print_mod=ValuationCalculations()

print_mod=ExecuteSensitivity()

print_mod=ExecuteSolver()

print_mod=PrintModel()

print(print_mod)

B. Run Sensitivity Analysis

#this section executes the sensitivity analysis prompts

print_mod3=ExecuteSensitivity()

print_mod3.execute_sensitivity()

print_mod3=ExecuteSolver()

print_mod3.execute_solver()

print_mod3=PrintModel()

print_mod3.sensitivity_analysis_section()

print_mod3.solver_analysis_section()

print(print_mod3)